Normally, I dislike the treatment of markets as natural, rather than intrinsically human, phenomena.

However, the subject of this article by Quartz is something altogether different. Biological symbiosis as a market- with induced scarcity and profiteering to boot. Altogether fascinating- I wonder what other biological interactions may in fact resemble a market?

Monday, August 24, 2015

[LINK] Blame Pepper for Imperialism, Bananas for Misery

One of the nerd obsessions I have that has not (really) found its way into the blog is the way that food and foodstuffs have affected human history. (Gastrohistory?)

Here's a really cool article from the Boston Globe that discusses exactly how European tastes helped to reshape the map- and what it means to us today.

Here's a really cool article from the Boston Globe that discusses exactly how European tastes helped to reshape the map- and what it means to us today.

Wednesday, August 19, 2015

[LINK] Purdue Wants To Sell Student's Future Income For Tuition

Purdue University is seeking a private investment firm to help them establish an Income Share Agreement program. This is NOT a new idea- they are more commonly called Human Capital Contracts and have been implemented- and promptly withdrawn- by universities in the past. And it appears they (Purdue) are not doing anything to resolve the adverse selection bias inherent in such a plan (people who are more likely to earn less are more likely to sign an ISA because it will be cheaper and vice versa.)

While it is nice that they are considering something new, I wonder if they teach the concept of moral hazards in their Econ classes?

Here's a cool academic article about risk based student loans by Michael Simkovic.

While it is nice that they are considering something new, I wonder if they teach the concept of moral hazards in their Econ classes?

Here's a cool academic article about risk based student loans by Michael Simkovic.

[ESSAY] The Kasparov Effect

"I'm sorry Frank, I think you missed it. Queen to bishop three, bishop takes queen, knight takes bishop, mate."- HAL 9000

February 10, 1996. The first time that a computer defeated a reigning world champion of chess (in this case, Garry Kasparov) using standard tournament rules. Deep Blue won Game 1 of the match. Speaking of his opponent, Kasparov stated "My late game attack would intimidate many players into making a mistake or two, but not this one." His coach would go on to tell TIME magazine that the defeat was "a shattering experience" for Kasparov. Garry Kasparov would go on to win 3 games and draw 2 of the remaining games in the match, ultimately concluding 4-2, Kasparov-Deep Blue.

Kasparov and IBM would go on to schedule a rematch for 1997. That match would ultimately end in Kasparov's defeat and the first match defeat of a reigning world champion by a computer using standard tournament rules.

Deep Blue versus Kasparov, Game 1 ended in victory for Kasparov. But Kasparov was mystified by Deep Blue's 44th move and subsequent resignation. He attributed Deep Blue's move to "superior intelligence" when, in all likelihood, it was a fail safe move (or a bug, according to WIRED). The program, when confronted with no optimal solution, merely chose one at random from all possible moves. Garry Kasparov's belief in the "superior intelligence" of Deep Blue would go on to hurt his game in subsequent matches.

Deep Blue versus Kasparov, Game 2 ended in victory by resignation for Deep Blue. Kasparov, showing signs of distress, sighing and rubbing his face, walked away and resigned after the 45th move, only to later be told that he could have fought the endgame to a perpetual check (and therefore, a draw.) "If he had not stormed off the stage and just played his normal game, he could've tied Deep Blue" (NPR) Garry Kasparov had let himself be psyched out, by a computer he would later say was "only intelligent the way your programmable alarm clock is intelligent."

Games 3, 4 and 5 ended with mutually agreed draw. Going into Game 6, the match was tied 2 1/2-2 1/2. There was yet hope for Luddites everywhere. It wouldn't last.

Deep Blue utterly defeated Garry Kasparov in that game, concluding in Kasparov's resignation by the 19th move. The whole game lasted under an hour. Naturally, Garry Kasparov, being a good sport and a gentlemanly competitor, accused the IBM Deep Blue team of cheating. He had come to believe that Deep Blue was being guided by a human player, a la the Mechanical Turk, despite his earlier recognition in the first match between himself and Deep Blue that the computer could play "wonderful and extremely human moves". At the post-match press conferences, he was described as "puffing and pouting". Kasparov would continue to accuse the IBM Deep Blue team of cheating before eventually just refusing to discuss his defeat against Deep Blue altogether.

Why did Garry Kasparov let himself get so flustered up against a machine opponent? Why was he such a sore loser after the fact? And what relevance does this have to the wider world?

Deep Blue was not necessarily a better chess player than Garry Kasparov. But unlike Garry Kasparov, Deep Blue was just a chess player. Garry Kasparov was a human with emotions and the possibility to err. More than Deep Blue defeating Kasparov, Deep Blue enabled Kasparov to defeat himself. As Mike Greengard, Kasparov's publicist and confidant, said "Deep Blue could calculate 200 million possible moves per second, but it was Kasparov who is overthinking it."

Garry Kasparov was not the first and will not be the last to be profoundly demoralized upon contact with machine intelligence. Inside Chess magazine's cover following the Kasparov defeat read ARMAGEDDON!

As the ubiquity of machine intelligence in the world only increases, we can expect only more anger and dejection, more feelings of defeat and coming doom. The wide range of human endeavors that machines are now invading will provoke a very raw, human response- a Kasparov Effect, if you will.

What will be the response to the first human casualties due to self-driving cars? Will the automation of jobs provoke more public rage and sympathy than the outsourcing that gutted American manufacturing and others? Should anger at the defeat of man by machine be a legitimate concern in public policy? Is the out-of-proportion emotional response these things will provoke justifiable and worthy of consideration? These are all questions that must be answered and stem from the same bewilderment that Kasparov faced in his rematch with Deep Blue in 1997.

Perhaps it is instructive to look at Garry Kasparov's statements before his second match against Deep Blue. He said "Inevitably the machines must win, but there is still a long way to go before a human on his or her best day is unable to defeat the best computer."

Inevitably the machines must win, indeed. How long a long way is remains to be determined.

Tuesday, August 18, 2015

[LINK] Block-Chain Transactions and Contract Law

In my essay On Technological Unemployment, I talked about how the coming age of automation will strike at all jobs, high-skilled and low-skilled. I didn't give many specifics in that essay, but this article by Quartz is a perfect example of what I was talking about.

I honestly hadn't considered the application of the cryptocurrency in this context, but that is precisely what is so terrifying and exhilarating about the many possibilities that lay before us. The applications far exceed even the initial thoughts of the wildest dreamers.

If contract law isn't safe from being taken out of human hands, what is?

I honestly hadn't considered the application of the cryptocurrency in this context, but that is precisely what is so terrifying and exhilarating about the many possibilities that lay before us. The applications far exceed even the initial thoughts of the wildest dreamers.

If contract law isn't safe from being taken out of human hands, what is?

[LINK] Political Consumerism in the 19th Century

Political consumerism is probably the main avenue of political expression for young Americans today- which is telling, in part, of just how tied up in the market system our culture is. Organic, free-range, Fair Trade, Green, everything has a label that can make you feel good just by buying it.

Cathy Kaufman has a really interesting article, entitled Salvation and Sweetness: Sugar Beets in Antebellum America about an earlier political consumerism attempt in American history. Definitely worth a read. Is 'Fair Trade' the 'free sugar' of today?

Cathy Kaufman has a really interesting article, entitled Salvation and Sweetness: Sugar Beets in Antebellum America about an earlier political consumerism attempt in American history. Definitely worth a read. Is 'Fair Trade' the 'free sugar' of today?

[MUSING] The Dismal Science

Economics is commonly called 'the dismal science.' Why is that? Is it the field's notorious unreliability in prediction? The spectre of Malthusianism? The dreary nature of discussing monetary policy? The utter, existential grayness of the men who study it? The cold reduction of the world into numbers and figures?

Well, not quite. The phrase "dismal science" first appeared in Occasional Discourse on the Negro Topic (1849) by Thomas Carlyle. "Not a 'gay science,' I should say, like some we have heard of; no, a dreary, desolate and, indeed, quite abject and distressing one; what we might call, by way of eminence, the dismal science."

Economics was a "dismal science" because it had found the secret of the universe in "supply-and-demand" and this universal law of "supply-and-demand" overrode all other laws of 'human governors'- reducing their duties 'to that of letting men alone.' This is similar to many criticisms of the field today- although it took a slightly different tack.

You see, Thomas Carlyle's tract supported the idea that slavery should be reintroduced to the Caribbean and he damned the nascent field of 'political economy' (as economics was then known) for not agreeing with him. He was absolutely enraged at the idea of a 'black Ireland', where men could not be compelled to work for less than what they determined to be their worth.

That is why economics is called the 'dismal science'. Because, when asked to support the institution of slavery, political economists of the day demurred. They went with what was right, rather than what was expected of them.

I'll take being dismal.

Monday, August 17, 2015

[LINK] Milton Friedman on the Grexit

Honestly, this is one of those things you read that seems almost eerie.... Something like the Grexit could have been and was predicted. There are a number of structural and historical problems with attempting something like the Euro.... so in hindsight this should have been obvious.

[ESSAY] On Technological Unemployment

Sir,

This

is to acquaint you that if your thrashing Machines

are

not destroyed by you directly

we

shall commence our labours

Signed

On

behalf of the whole

Swing

The

above is a fairly typical example of the sort of letters sent by the

Swing Rioters of 1830s England. Their demands were simple- the

destruction of the crude machines that reduced the number of hired

farm-hands needed to bring in a harvest. Their procedure was likewise

simple- they would send a letter like that above and, if their

demands were not met, they would take matters into their own hands

and destroy the machines themselves. The Swing Rioters destroyed

their first threshing machine on 28 April 1830. By the middle of

October of that year, they had destroyed more than 100. They marched

in the streets by day and set fire to threshing machines, barns,

mills and fences under the cover of night. Their battle-cry, heard in

towns large and small throughout southwest England, was“Bread or

Blood!”

The

Swing Rioters were variably killed, imprisoned or exiled to

Australia. Some were merely left jobless and destitute, to be swept

up, as so many others were, into the Second Industrial Revolution.

The “thrashing Machines” kept on bringing in the harvest. History

marched on. The Swing Rioters were not the first or the last to

protest the replacement of men by machines, but their experience was

mostly typical. The humans lost, the machines won.

Nowadays,

we do not give a thought to the intensive mechanization of

agriculture- and it far exceeds that found in the days of the Swing

Rioters. In 1900, 41 percent of the American populace was employed in

agriculture. In 2012, only 1.5% of the American populace was likewise

employed, with almost no change in the amount of land under

cultivation and an increase in productivity, both total and

per-person. This sea change was far beyond even the most feverish

speculations of the Swing Rioters. Yet, with the exception of

Depression Era populism (itself coinciding with the first halving of

American agricultural employment in 1930), there were no calls for

“Bread or Blood!” in twentieth century America.

John

Maynard Keynes, coining the term technological unemployment, wrote in

1930: "We are being afflicted with a new disease of which some

readers may not yet have heard the name, but of which they will hear

a great deal in the years to come – namely, technological

unemployment.

This means unemployment due to our discovery of means of economizing

the use of labor outrunning the pace at which we can find new uses

for labor. But this is only a temporary phase of maladjustment.”

Keynes' claim that “technological unemployment” was merely a

“temporary phase of maladjustment” became the mainstream view in

economics, with good reason. For much of the twentieth century, jobs

replaced due to technology were replaced in short order by jobs

enabled either by the new technology or due to the freeing up of

labor reserves. From 1947 to 2000, productivity gains outside of

agriculture and employment outside of agriculture were closely tied

and followed the same general curve. Productivity gains from the

economizing of labor could be said to lead to increased employment.

Evidence-based economics at its finest. Technological unemployment

was, in essence, self-correcting- if it existed at all.

In

2000, however, the curves became decoupled. A rise in productivity

and real output was accompanied by a decline in overall employment- a

trend that has continued, mostly unabated, to the present day. It is

no longer clear that technological unemployment is self-correcting.

The

Swing Rioters had no recourse except to violence. Trapped between the

enclosure of the commons, anti-vagrancy laws and the odious Poor Laws

of England, unable to imagine any economic activity other than

agriculture (the primary human economic activity for much of recorded

history), they burned machines and mills because there was no

alternative. It was a matter of bread or blood. In contrast, the

agricultural workers of the twentieth century United States had no

reason to resort to violence. The United States government supported

full employment as a matter of policy. The post-WWII consensus on

education pushed record numbers of students through American colleges

and universities. In 1956, white-collar workers finally came to

outnumber blue-collar workers in America, for the first time anywhere

in human history. It was easy to imagine a world where agriculture

was not the primary economic activity- because it hadn't been for

some time. It was a temporary phase of maladjustment.

Our

situation is different and more dramatic than either. Lawrence H.

Summers, former US Secretary of the Treasury, wrote in 2014: "There

are many reasons to think the software revolution will be even more

profound than the agricultural revolution. This time around, change

will come faster and affect a much larger share of the economy. [...]

There are more sectors losing jobs than creating jobs. And the

general-purpose aspect of software technology means that even the

industries and jobs that it creates are not forever."

The

coming age of automation will not affect one sector, allowing the

movement of excess labor into a new, labor-intensive endeavor. The

coming age of automation strikes at all levels of and all forms of

employment. Routine manual labor. Difficult cognitive tasks.

Transportation. Administration. White-collar and blue-collar, alike.

Algorithms may as easily be adapted for use in machine-guided cutting

as in cost-benefit analysis. Machines may come to replace doctors as

easily as they replace factory workers.

Whether

technological unemployment will become a question of “Bread or

Blood” or “a temporary phase of maladjustment” is entirely in

our hands.

References

US

Department of Agriculture, The

20th Century Transformation of U.S. Agriculture and Farm Policy,

retrieved

from Economic Information Bulletin, Economic Research Service

http://www.ers.usda.gov/media/259572/eib3_1_.pdf,

June 1, 2015

Keynes,

John M. "Economic

Possibilities For Our Grandchildren",

Essays

in Persuasion

(1930):

W.W. Norton & Co. Retrieved from Economics Department, Yale

University http://www.econ.yale.edu/smith/econ116a/keynes1.pdf,

June 1, 2015

US.

Bureau of Labor Statistics,All

Employees: Total nonfarm [PAYEMS],

retrieved from FRED, Federal Reserve Bank of St. Louis

https://research.stlouisfed.org/fred2/series/PAYEMS/, June 1, 2015.

US.

Bureau of Labor Statistics,Nonfarm

Business Sector: Real Output Per Hour of All Persons[OPHNFB],

retrieved from FRED, Federal Reserve Bank of St. Louis

https://research.stlouisfed.org/fred2/series/OPHNFB/, June 1, 2015.

Summers,

Lawrence H. "Lawrence

H. Summers on the Economic Challenge of the Future: Jobs."

Editorial. Wall

Street Journal

7 July 2014. Retrieved

from Wall Street Journal, June 1, 2015

Sunday, February 8, 2015

[REVIEW] The End of Power

DISCLAIMER: I will be judging Moises Naim's The End of Power separate from my problems with the book presented here and here. While my contentions there remain, I will try to judge The End of Power separate from those issues.

The End of Power by Moises Naim is the first pick in Facebook founder Mark Zuckerberg's Year of Books. The book purports to explain and explore the changes in power during recent decades- "From boardrooms to battlefields and churches to states, why being in charge isn't what it used to be", as the cover states.

The model he proposes for examining power and the decay of power is perhaps the best part of the book. First, he defines power. 'Power is the ability to direct or prevent the current or future actions of other groups and individuals.' As he states in the text, this is similar to political scientist Robert Dahl's definition of power given in The Concept of Power. "A has power over B to the extent that he can get B to do something that B would not otherwise do." He identifies what he calls the four channels of power- the means through which power is expressed and employed. They are The Muscle, The Code, The Pitch and The Reward. This is a clean and simple division that really does encapsulate most options and doesn't require much explanation. Even if we were to try and introduce another 'channel' into this model (say, The Drive for the use of intrinsic motivation) it could easily be explained away as a synthesis of two 'basic' channels of power- in that case, The Pitch and The Code.

He goes on to analyze the accumulation and distribution of power from an economics perspective, using the idea of 'barriers to entry' and 'market power'. I am always fond of the use of Economics as Universal Toolkit and Moises Naim does this well. He then explains why 'big' became almost synonymous with 'powerful'. Ranging from Max Weber's belief in the power of bureaucracy to Ronald Coase's Nature of The Firm and his elucidation of economies of scale and transaction costs, his analysis is sharp and edifying.

He then proposes why the nature of power is changing- why large actors seem more constrained and less effective than their smaller competitors. His economic analysis is important here; he identifies the changing nature of transaction costs, the existence of 'diseconomies of scale' (my terminology) and, ultimately, the lowering of barriers to entry in nearly all fields. He tends to downplay the Internet as the primary game changer in the structure of power. He considers it only one factor among many, which is refreshing. He identifies three 'revolutions' affecting the employment of power- More, Mobility and Mentality. The More Revolution: 'Overwhelming the means of control.' The Mobility Revolution: 'The end of captive audiences'. The Mentality Revolution: Taking nothing for granted Anymore.' This is an intuitive and flexible model- and better yet, it is simple and can be universally applied without much problem. Each of these is tied to his earlier use of 'barriers of entry' and to his 'channels of power' to show how each one complicates the exercise and accumulation of power.

It is after the demonstration of his model that the book really declines in quality. Editing is extraordinarily poor for a book of this type. For one example, he continually hints at an analysis of education using his model in the earlier chapters. He ends a later chapter with, and I'm paraphrasing: This chapter could have been about education. His charts and visual aids are even worse- I had to wonder if his publisher gave him a quota. One of his charts is a U-curve he uses to explain that too much power and too little power have their own problems. The X axis is labelled (confusingly) Decay of power and the Y axis is labeled with the practically non-descript phrase political and social stability, economic vitality. It is a completely worthless chart, dropped into the middle of the text without reason and without any basis in fact.

The quality of his commentary on the 'decay of power' and the examples he chooses to prove his thesis are equally poor. In the military focused chapter, I found his emphasis on 'drones' to be particularly jarring and a waste of space. One line stuck out in particular: "More disturbing, ordinary hobbyists and private users abound: in the United States in 2012 a group called DIY Drones had twenty thousand members." He isn't the only one to get scared about drones since we stopped calling them RC planes, but there were infinitely better examples that could have been used. He never talks about the massive deployment of Palestinian rockets and Israel's construction of the Iron Dome, for example. He doesn't talk about denial-of-service attacks done in conjunction with rocket strikes or about the terrifying rise of 'armchair jihadists' as even a concept, much less a reality. (I said I wouldn't use his poor citation of sources in this review but it bears mentioning: when talking about the possible use of drones by terrorist groups and about a confirmed use by Hezbollah of drone use in 2004, he instead cites this article- which is about the use of drones by Israeli security forces and the culture of fear it has created among Palestinians.)

He promises at the beginning of The End of Power that "this is not a call to feel sorry for those in power." He presumably forgot that promise somewhere in the editing process, because his entire section on what is to be done about the decay of power as well as his commentary on the negative effects of the decay of power is impossible to read as anything but "a call to feel sorry for those in power." He argues that democratic societies need to give their governments more power over their lives- and while he's not alone in this contention, it is nothing more than the final lament of a 20th century technocrat at the dawn of the 21st. There are some good points to his final analysis, but they don't outweigh the bad.

The End of Power presents a useful model for understanding power's changing nature in the modern day. Moises Naim then proceeds to do nothing useful or thought-provoking with that model for 200 pages. I would recommend this book only for those interested in the model and nothing else. The flaws outside of his model-building portions make this book not worth the effort.

Final musing- Why Mark Zuckerberg Picked This Book: References to Facebook and the tech industry abound throughout The End of Power and well they should. (Moises Naim often says they succeed for the same reasons al-Qaeda did, which is useful for grabbing attention if nothing else.) The tech industry's 'disruption' of various industries are the David vs. Goliath struggles that many now imagine when talking about the changing nature of power. The nimble startup fending off the industry giant is ingrained into the public consciousness and is brought up everywhere, critically or no, from Uber's fights with taxi companies to Kodak's replacement by Instagram. We live in a world where private companies such as SpaceX and Virgin Galactic define space travel more than NASA. Mark Zuckerberg picked this book because the rise of Silicon Valley is just one expression of the end of power.

UP NEXT: The Better Angels of Our Nature: Why Violence Has Declined, Steven Pinker, A Year of Books' 2nd pick

He goes on to analyze the accumulation and distribution of power from an economics perspective, using the idea of 'barriers to entry' and 'market power'. I am always fond of the use of Economics as Universal Toolkit and Moises Naim does this well. He then explains why 'big' became almost synonymous with 'powerful'. Ranging from Max Weber's belief in the power of bureaucracy to Ronald Coase's Nature of The Firm and his elucidation of economies of scale and transaction costs, his analysis is sharp and edifying.

He then proposes why the nature of power is changing- why large actors seem more constrained and less effective than their smaller competitors. His economic analysis is important here; he identifies the changing nature of transaction costs, the existence of 'diseconomies of scale' (my terminology) and, ultimately, the lowering of barriers to entry in nearly all fields. He tends to downplay the Internet as the primary game changer in the structure of power. He considers it only one factor among many, which is refreshing. He identifies three 'revolutions' affecting the employment of power- More, Mobility and Mentality. The More Revolution: 'Overwhelming the means of control.' The Mobility Revolution: 'The end of captive audiences'. The Mentality Revolution: Taking nothing for granted Anymore.' This is an intuitive and flexible model- and better yet, it is simple and can be universally applied without much problem. Each of these is tied to his earlier use of 'barriers of entry' and to his 'channels of power' to show how each one complicates the exercise and accumulation of power.

It is after the demonstration of his model that the book really declines in quality. Editing is extraordinarily poor for a book of this type. For one example, he continually hints at an analysis of education using his model in the earlier chapters. He ends a later chapter with, and I'm paraphrasing: This chapter could have been about education. His charts and visual aids are even worse- I had to wonder if his publisher gave him a quota. One of his charts is a U-curve he uses to explain that too much power and too little power have their own problems. The X axis is labelled (confusingly) Decay of power and the Y axis is labeled with the practically non-descript phrase political and social stability, economic vitality. It is a completely worthless chart, dropped into the middle of the text without reason and without any basis in fact.

The quality of his commentary on the 'decay of power' and the examples he chooses to prove his thesis are equally poor. In the military focused chapter, I found his emphasis on 'drones' to be particularly jarring and a waste of space. One line stuck out in particular: "More disturbing, ordinary hobbyists and private users abound: in the United States in 2012 a group called DIY Drones had twenty thousand members." He isn't the only one to get scared about drones since we stopped calling them RC planes, but there were infinitely better examples that could have been used. He never talks about the massive deployment of Palestinian rockets and Israel's construction of the Iron Dome, for example. He doesn't talk about denial-of-service attacks done in conjunction with rocket strikes or about the terrifying rise of 'armchair jihadists' as even a concept, much less a reality. (I said I wouldn't use his poor citation of sources in this review but it bears mentioning: when talking about the possible use of drones by terrorist groups and about a confirmed use by Hezbollah of drone use in 2004, he instead cites this article- which is about the use of drones by Israeli security forces and the culture of fear it has created among Palestinians.)

He promises at the beginning of The End of Power that "this is not a call to feel sorry for those in power." He presumably forgot that promise somewhere in the editing process, because his entire section on what is to be done about the decay of power as well as his commentary on the negative effects of the decay of power is impossible to read as anything but "a call to feel sorry for those in power." He argues that democratic societies need to give their governments more power over their lives- and while he's not alone in this contention, it is nothing more than the final lament of a 20th century technocrat at the dawn of the 21st. There are some good points to his final analysis, but they don't outweigh the bad.

The End of Power presents a useful model for understanding power's changing nature in the modern day. Moises Naim then proceeds to do nothing useful or thought-provoking with that model for 200 pages. I would recommend this book only for those interested in the model and nothing else. The flaws outside of his model-building portions make this book not worth the effort.

Final musing- Why Mark Zuckerberg Picked This Book: References to Facebook and the tech industry abound throughout The End of Power and well they should. (Moises Naim often says they succeed for the same reasons al-Qaeda did, which is useful for grabbing attention if nothing else.) The tech industry's 'disruption' of various industries are the David vs. Goliath struggles that many now imagine when talking about the changing nature of power. The nimble startup fending off the industry giant is ingrained into the public consciousness and is brought up everywhere, critically or no, from Uber's fights with taxi companies to Kodak's replacement by Instagram. We live in a world where private companies such as SpaceX and Virgin Galactic define space travel more than NASA. Mark Zuckerberg picked this book because the rise of Silicon Valley is just one expression of the end of power.

UP NEXT: The Better Angels of Our Nature: Why Violence Has Declined, Steven Pinker, A Year of Books' 2nd pick

Saturday, February 7, 2015

[MUSING] Why Wall Street Is Excited About Cable Companies Being Treated As Utilities

As detailed in Kevin Drum's Mother Jones article here, the stock prices for major cable companies went up following the FCC's proposal to enforce strict net neutrality rules. Why? After all, regulation is bad, right?

Wrong.

I don't believe Kevin Drum got it right anymore than I think the high paid analysts at BTIG got it right. The analysts believe it was because price regulation wasn't mentioned- and it never has been, except by the internet service providers themselves. Kevin Drum believes it is because Wall Street doesn't know what it is doing. (Efficient market hypothesis notwithstanding, that is not the case)

Regulation of internet service providers is a net good for the business of internet service providers and anyone with a modicum of common sense (read: not the internet service providers themselves) realizes this. That is why the content creators of the Internet lined up almost universally on the side of net neutrality.

The thing that sells a utility is not the product itself- its the possibilities. We don't buy electricity because we like electricity and want to keep turbines somewhere spinning. We buy electricity because it enables all of our other wondrous, modern devices. It is the same with the internet. We don't buy internet packages because we love the idea of cables transmitting 1s and 0s. We buy internet access from the internet service providers because it gives us access to all of the many wondrous services available on the internet. And many of those services would not exist if internet service providers had anything to say about it. Remember the Netflix-Comcast feud?

If internet service providers are given the ability to decide what services will run through 'their' internet, the Internet as we know it will cease to exist. The reasons people would have to buy internet access would dwindle and the internet service providers would ultimately suffer. What would be the valuation of General Electric if they had to produce a new product for every power provider? What would the valuation of electric power generation be? Would it have ever become ubiquitous?

Regulation is, in this case, good. Wall Street has long followed Silicon Valley's lead (see: the tech bubble of the 90s) and this is just an extension of that.

Wrong.

I don't believe Kevin Drum got it right anymore than I think the high paid analysts at BTIG got it right. The analysts believe it was because price regulation wasn't mentioned- and it never has been, except by the internet service providers themselves. Kevin Drum believes it is because Wall Street doesn't know what it is doing. (Efficient market hypothesis notwithstanding, that is not the case)

Regulation of internet service providers is a net good for the business of internet service providers and anyone with a modicum of common sense (read: not the internet service providers themselves) realizes this. That is why the content creators of the Internet lined up almost universally on the side of net neutrality.

The thing that sells a utility is not the product itself- its the possibilities. We don't buy electricity because we like electricity and want to keep turbines somewhere spinning. We buy electricity because it enables all of our other wondrous, modern devices. It is the same with the internet. We don't buy internet packages because we love the idea of cables transmitting 1s and 0s. We buy internet access from the internet service providers because it gives us access to all of the many wondrous services available on the internet. And many of those services would not exist if internet service providers had anything to say about it. Remember the Netflix-Comcast feud?

If internet service providers are given the ability to decide what services will run through 'their' internet, the Internet as we know it will cease to exist. The reasons people would have to buy internet access would dwindle and the internet service providers would ultimately suffer. What would be the valuation of General Electric if they had to produce a new product for every power provider? What would the valuation of electric power generation be? Would it have ever become ubiquitous?

Regulation is, in this case, good. Wall Street has long followed Silicon Valley's lead (see: the tech bubble of the 90s) and this is just an extension of that.

[REVIEW] Problems With The End Of Power (Update)

187 pages late, Moises Naim does properly cite Spirit and Power- A 10-Country Survey of Pentecostals correctly. It is a segment that is almost directly copy-pasted from his earlier statement on pages 8-9. (My original problems with this are detailed here; my problems with The End of Power's editing will be covered in a future blog post.)

As detailed in that blog post, a lack of proper citation is not the only problem with the way Moises Naim uses this study. While he adopts the terminology of the survey ("Renewalist") he never explains to the reader that this umbrella term, for the purposes of the survey, happens to include a fair number of Catholics. This has a direct impact on his argument.

What's worse is that India was omitted from his earlier passage, but not in this later segment. Moises Naim writes on page 195, "Even in 'non-Christian' India, renewalists make up 5 percent of the population."

From the Survey Methology section of Spirit and Power: "In India, the survey was conducted in three states believed to have among the highest percentage of Christians in India: Tamil Nadu, Kerala and Meghalaya. Within the three selected states, districts with the highest proportion of Christians were first selected, and then sampling points were randomly selected from these districts. This survey is NOT representative of the general population of India, nor is it representative of the population of the three Indian states in which it was conducted." My emphasis is in bold. Total Christian share of the Indian population (all denominations) is likely to be substantially less than 5%. In 2001, it was only 2.4%. The 2011 Indian Census Data on religion has not yet been released- although forecasts emphasize the growth in Muslim's share of the population, not that of Christians.

Moises Naim's publisher has still not answered my email about why this study was not properly cited at its first appearance in the text, nor have they explained where the 5% number for 1960 comes from and what it was actually measuring.

Some may say I am nitpicking, but small things like this make me think there is either shoddy research in his book or, worse, an intentional reworking of facts to fit his thesis. Religious demographics may just be the one thing I could catch him on.

As detailed in that blog post, a lack of proper citation is not the only problem with the way Moises Naim uses this study. While he adopts the terminology of the survey ("Renewalist") he never explains to the reader that this umbrella term, for the purposes of the survey, happens to include a fair number of Catholics. This has a direct impact on his argument.

What's worse is that India was omitted from his earlier passage, but not in this later segment. Moises Naim writes on page 195, "Even in 'non-Christian' India, renewalists make up 5 percent of the population."

From the Survey Methology section of Spirit and Power: "In India, the survey was conducted in three states believed to have among the highest percentage of Christians in India: Tamil Nadu, Kerala and Meghalaya. Within the three selected states, districts with the highest proportion of Christians were first selected, and then sampling points were randomly selected from these districts. This survey is NOT representative of the general population of India, nor is it representative of the population of the three Indian states in which it was conducted." My emphasis is in bold. Total Christian share of the Indian population (all denominations) is likely to be substantially less than 5%. In 2001, it was only 2.4%. The 2011 Indian Census Data on religion has not yet been released- although forecasts emphasize the growth in Muslim's share of the population, not that of Christians.

Moises Naim's publisher has still not answered my email about why this study was not properly cited at its first appearance in the text, nor have they explained where the 5% number for 1960 comes from and what it was actually measuring.

Some may say I am nitpicking, but small things like this make me think there is either shoddy research in his book or, worse, an intentional reworking of facts to fit his thesis. Religious demographics may just be the one thing I could catch him on.

Monday, February 2, 2015

[REVIEW] Problems with The End of Power (Already)

On pages 8-9 of The End of Power by Moises Naim, he writes "Similarly the long-entrenched power of the major organized religions is decaying at a remarkable pace. For instance, Pentecostal churches are advancing in countries in countries that were once strongholds of the Vatican and mainline Protestant churches. In Brazil, Pentecostals and Charismatics made up only 5 percent of the population in 1960- compared to 49 percent in 2006. (They comprise 11 percent in South Korea, 23 percent in the United States, 26 percent in Nigeria, 30 percent in Chile, 56 percent in Kenya, and 60 percent in Guatemala.)"

There is no citation given for these assertions. There is no footnote explaining where these numbers come from. However, the numbers given by Moises Naim in the text are identical to the numbers found in a Pew Research Center study entitled 'Spirit and Power- A 10-Country Survey of Pentecostals'. Of the 10 countries in that report, Moises Naim lists 9. I am going to be contacting the publisher shortly to determine if they can shed any light on this issue. It is a pretty grievous error if they had no knowledge of this study being used and not being cited.

However, it is a troubling sign for this book regardless of whether the citation was merely overlooked. Using the study that he did and framing it in the way he did above is intentionally misleading. I can't determine if the "5 percent of the population in 1960" refers only to Pentecostals or if it derives from the Brazilian census because, as said, there are no citations and such a number does not appear in the Pew Research Center study above. What is likely that it did not include "Charismatics", as the identification of non-Pentecostal Christians as Charismatics would post-date any 1960 report. (Source)

If he had used only the Pentecostal numbers, he would have stated that 15% of the Brazilian population is Pentecostal, which would still support his thesis, just not as strongly. As the Pew Research Center Study states "most charismatics are members of mainstream Protestant, Catholic and Orthodox denominations." That is in direct contradiction to the way he introduces this data- as a sign that the Catholic Church and the mainstream Protestant churches are failing. If they are adopting Charismatic practice and doing well with it, that is clearly not the case. Using their share of the population as an argument to the contrary is dishonest and misleading to the reader.

I will continue to read The End of Power, but with a much more critical eye. I will post any updates or clarifications from the publisher as I receive them.

There is no citation given for these assertions. There is no footnote explaining where these numbers come from. However, the numbers given by Moises Naim in the text are identical to the numbers found in a Pew Research Center study entitled 'Spirit and Power- A 10-Country Survey of Pentecostals'. Of the 10 countries in that report, Moises Naim lists 9. I am going to be contacting the publisher shortly to determine if they can shed any light on this issue. It is a pretty grievous error if they had no knowledge of this study being used and not being cited.

However, it is a troubling sign for this book regardless of whether the citation was merely overlooked. Using the study that he did and framing it in the way he did above is intentionally misleading. I can't determine if the "5 percent of the population in 1960" refers only to Pentecostals or if it derives from the Brazilian census because, as said, there are no citations and such a number does not appear in the Pew Research Center study above. What is likely that it did not include "Charismatics", as the identification of non-Pentecostal Christians as Charismatics would post-date any 1960 report. (Source)

If he had used only the Pentecostal numbers, he would have stated that 15% of the Brazilian population is Pentecostal, which would still support his thesis, just not as strongly. As the Pew Research Center Study states "most charismatics are members of mainstream Protestant, Catholic and Orthodox denominations." That is in direct contradiction to the way he introduces this data- as a sign that the Catholic Church and the mainstream Protestant churches are failing. If they are adopting Charismatic practice and doing well with it, that is clearly not the case. Using their share of the population as an argument to the contrary is dishonest and misleading to the reader.

I will continue to read The End of Power, but with a much more critical eye. I will post any updates or clarifications from the publisher as I receive them.

Sunday, February 1, 2015

[REVIEW] Capitalism, Socialism and Democracy

Capitalism, Socialism and Democracy is widely considered Joseph A. Schumpeter's magnum opus. The book truly is deserving of the title of great work- it is a sprawling economics text that explores the topic of capitalism's survival from a strangely modern, interdisciplinary viewpoint.

I believe before going on I should state that Capitalism, Socialism and Democracy is written FOR ACADEMIC EYES ONLY. It is a very heavy and trying read and I don't say that about many texts. This may be the age of the text itself (it was written in 1942, after all) but I feel the book was often written in an unnecessarily complicated and obtuse manner, even when compared to the book's contemporaries. I couldn't complete the book in one go and that is a rarity for me.

Capitalism, Socialism and Democracy is broken up into five distinct chapters. I won't bore you with the table of contents but, in reality, it often reads more as a collection of books than one single work. Each one could have been an enjoyable book on its own. I found this did help to reduce some of the burden of reading such a text- there was the relief of a different topic always on the horizon.

The first part deals with the importance of Marx in his roles as prophet, sociologist, economist and teacher. This part is hugely uninteresting to those who have no interest in Marx and Schumpeter says as much in his introduction. However, for those who have an interest in Marxist or Marxian thought, it is an interesting analysis, especially coming from a writer who disagrees so vehemently with Marxists and their ideological successors. I found his evaluation of Marx to be roughly in-line with my own. His was an opinion I hadn't often seen stated, so I quite enjoyed this chapter. It was among the hardest to read, as anyone well-versed in Marxism could probably guess.

The second chapter deals with what could be called the central theme of Capitalism, Socialism and Democracy. Schumpeter asks the reader "Can capitalism survive?" His answer is as clear as it is shocking. "No. I do not believe it can." This is perhaps the best part of the book. Schumpeter outlines how capitalism destroys the very social structures it relies on for its existence. This is reminiscent of the historical viewpoint that it was capitalism that destroyed feudalism- only Schumpeter shows capitalism does the same to itself. Capitalism, through the creation of the intellectual class, creates a class intrinsically opposed to capitalism and its structures. Capitalism, relying on the process of "primitive accumulation" by entrepreneurs and other entrants to the bourgeoisie, slowly creates roadblocks for the process of primitive accumulation. Capitalism, having created the modern state out of convenience, now finds itself "fettered" by the very type of state it helped to birth. Capitalism, relying on principles of enlightened self-interest, creates a class of administrators who have no personal stake in the very property they manage. This is a really enlightening part of the book and certain portions seem oddly prescient.

For example, he discusses how modern capitalism destroys the pre-modern bourgeois family ideal as well as "dematerializing" property ownership. Writing as he was in 1942, he discusses how the declining importance of the home has opened up certain segments of the economy once contained in the household- hospitality, specifically- to the market at large. The result is the ascendancy during the post-War period of restaurants and the hospitality sector. The economic rationale behind aspiring to a "manorial" way of living disappeared, taking to market one aspect of home life no longer economica;. I find this a really interesting idea to explore- just look at how modern services like Zipcar and other sharing economy startups "outsource" the economic costs of owning and maintaining a car. The fact that such a thing is even considered a viable business is a definite effect of our changing relationship to property and a change in our aspirations towards ownership of property.

This is also the part of the book where he discusses "creative destruction", the modern conception of which we owe to him. (It is often known as Schumpeter's Gale.) This part of the book should be of great interest to anyone interested in the tech industry- where disruptive innovation is very much in vogue and which is, in reality, just another expression of creative destruction.

The third part deals with whether socialism, conceived as bureaucratic control of the economy, can work. Schumpeter believes that it could, in fact, work. Writing as he was before the realities of the Soviet system were revealed, he can be forgiven for some of his errors here, but the primary point of this chapter was merely as a proof-of-concept. He believes that rational price markers could still be expressed through a bureaucratic means- a denial of Ludwig von Mises' Economic Planning In The Socialist Commonwealth. Those familiar with Alvin Toffler's works will likely see the parallels with his much later "economy as switchboard" metaphor. It makes a certain sort of sense in the time, as industrial consolidation and bureaucratization of management were alive and well even in the most avowedly of capitalist countries. Realistically, one could presume that socialist management would not look much different. He also opines on the ability of a socialist state to instill discipline in the populace in excess of the means available to a capitalist state- a chapter that he readily admits is chilling, even as we have the advantage of having seen the limits of such 'discipline'.

The fourth part deals with the relationship of socialism to democracy. This is yet another prescient and thoroughly enjoyable part of the book. He savages the idea of democracy as an ideal or a goal and makes the reader look at it for what it is- a method, bound to produce any manner of undesirable results. In a surprisingly forward-thinking interdisciplinary stroke, he looks at examples of crowd psychology to explain the problems democracy as a system has in working. Many of the passages seem eerily prophetic as in his depiction of capitalism's demise earlier in the book. It is hard to imagine a politics of trivialities and division, ruled by lobbyists and propagandists, truly described the politics of the United States in the forties, but it is easy to imagine those words being written today. (And in fact, he is still cited today, although not often for his critiques of democracy.) Unlike many other writers I am aware of, he insists such an evolution is an inevitability of democracy, which is a darkly pessimistic view to take, no matter how well-founded.

The fifth part deals with the history of socialist parties in Europe and the United States. This chapter is primarily of interest to the sorts of people who were interested in the first chapter. If you aren't a student of Marxism, most of this chapter could be skipped. This is also where Schumpeter reveals some shortsightedness- particularly in his predictions of what would happen in the United States following World War II. Despite seeming like a prophet of the modern day in his earlier chapters, here he fails completely to recognize what would happen in the post-War period. He isn't even close to the mark.

Overall, Capitalism, Socialism and Democracy was a worthy read. Trying at times, but the moments of brilliance were well worth it. I would highly recommend it to anyone interested in economics and willing to persevere.

Final thought: "Assassinations might be futile and productive of nothing but repression but there was not much else to do." That sentence is probably the best description of late 19th-early 20th century Russian political violence ever written.

UP NEXT: The End of Power, Moises Naim (A Year of Books' 1st pick)

I believe before going on I should state that Capitalism, Socialism and Democracy is written FOR ACADEMIC EYES ONLY. It is a very heavy and trying read and I don't say that about many texts. This may be the age of the text itself (it was written in 1942, after all) but I feel the book was often written in an unnecessarily complicated and obtuse manner, even when compared to the book's contemporaries. I couldn't complete the book in one go and that is a rarity for me.

Capitalism, Socialism and Democracy is broken up into five distinct chapters. I won't bore you with the table of contents but, in reality, it often reads more as a collection of books than one single work. Each one could have been an enjoyable book on its own. I found this did help to reduce some of the burden of reading such a text- there was the relief of a different topic always on the horizon.

The first part deals with the importance of Marx in his roles as prophet, sociologist, economist and teacher. This part is hugely uninteresting to those who have no interest in Marx and Schumpeter says as much in his introduction. However, for those who have an interest in Marxist or Marxian thought, it is an interesting analysis, especially coming from a writer who disagrees so vehemently with Marxists and their ideological successors. I found his evaluation of Marx to be roughly in-line with my own. His was an opinion I hadn't often seen stated, so I quite enjoyed this chapter. It was among the hardest to read, as anyone well-versed in Marxism could probably guess.

The second chapter deals with what could be called the central theme of Capitalism, Socialism and Democracy. Schumpeter asks the reader "Can capitalism survive?" His answer is as clear as it is shocking. "No. I do not believe it can." This is perhaps the best part of the book. Schumpeter outlines how capitalism destroys the very social structures it relies on for its existence. This is reminiscent of the historical viewpoint that it was capitalism that destroyed feudalism- only Schumpeter shows capitalism does the same to itself. Capitalism, through the creation of the intellectual class, creates a class intrinsically opposed to capitalism and its structures. Capitalism, relying on the process of "primitive accumulation" by entrepreneurs and other entrants to the bourgeoisie, slowly creates roadblocks for the process of primitive accumulation. Capitalism, having created the modern state out of convenience, now finds itself "fettered" by the very type of state it helped to birth. Capitalism, relying on principles of enlightened self-interest, creates a class of administrators who have no personal stake in the very property they manage. This is a really enlightening part of the book and certain portions seem oddly prescient.

For example, he discusses how modern capitalism destroys the pre-modern bourgeois family ideal as well as "dematerializing" property ownership. Writing as he was in 1942, he discusses how the declining importance of the home has opened up certain segments of the economy once contained in the household- hospitality, specifically- to the market at large. The result is the ascendancy during the post-War period of restaurants and the hospitality sector. The economic rationale behind aspiring to a "manorial" way of living disappeared, taking to market one aspect of home life no longer economica;. I find this a really interesting idea to explore- just look at how modern services like Zipcar and other sharing economy startups "outsource" the economic costs of owning and maintaining a car. The fact that such a thing is even considered a viable business is a definite effect of our changing relationship to property and a change in our aspirations towards ownership of property.

This is also the part of the book where he discusses "creative destruction", the modern conception of which we owe to him. (It is often known as Schumpeter's Gale.) This part of the book should be of great interest to anyone interested in the tech industry- where disruptive innovation is very much in vogue and which is, in reality, just another expression of creative destruction.

The third part deals with whether socialism, conceived as bureaucratic control of the economy, can work. Schumpeter believes that it could, in fact, work. Writing as he was before the realities of the Soviet system were revealed, he can be forgiven for some of his errors here, but the primary point of this chapter was merely as a proof-of-concept. He believes that rational price markers could still be expressed through a bureaucratic means- a denial of Ludwig von Mises' Economic Planning In The Socialist Commonwealth. Those familiar with Alvin Toffler's works will likely see the parallels with his much later "economy as switchboard" metaphor. It makes a certain sort of sense in the time, as industrial consolidation and bureaucratization of management were alive and well even in the most avowedly of capitalist countries. Realistically, one could presume that socialist management would not look much different. He also opines on the ability of a socialist state to instill discipline in the populace in excess of the means available to a capitalist state- a chapter that he readily admits is chilling, even as we have the advantage of having seen the limits of such 'discipline'.

The fourth part deals with the relationship of socialism to democracy. This is yet another prescient and thoroughly enjoyable part of the book. He savages the idea of democracy as an ideal or a goal and makes the reader look at it for what it is- a method, bound to produce any manner of undesirable results. In a surprisingly forward-thinking interdisciplinary stroke, he looks at examples of crowd psychology to explain the problems democracy as a system has in working. Many of the passages seem eerily prophetic as in his depiction of capitalism's demise earlier in the book. It is hard to imagine a politics of trivialities and division, ruled by lobbyists and propagandists, truly described the politics of the United States in the forties, but it is easy to imagine those words being written today. (And in fact, he is still cited today, although not often for his critiques of democracy.) Unlike many other writers I am aware of, he insists such an evolution is an inevitability of democracy, which is a darkly pessimistic view to take, no matter how well-founded.

The fifth part deals with the history of socialist parties in Europe and the United States. This chapter is primarily of interest to the sorts of people who were interested in the first chapter. If you aren't a student of Marxism, most of this chapter could be skipped. This is also where Schumpeter reveals some shortsightedness- particularly in his predictions of what would happen in the United States following World War II. Despite seeming like a prophet of the modern day in his earlier chapters, here he fails completely to recognize what would happen in the post-War period. He isn't even close to the mark.

Overall, Capitalism, Socialism and Democracy was a worthy read. Trying at times, but the moments of brilliance were well worth it. I would highly recommend it to anyone interested in economics and willing to persevere.

Final thought: "Assassinations might be futile and productive of nothing but repression but there was not much else to do." That sentence is probably the best description of late 19th-early 20th century Russian political violence ever written.

UP NEXT: The End of Power, Moises Naim (A Year of Books' 1st pick)

Friday, January 30, 2015

Update

Hello all. I've been inactive for a hot second, due to various life issues- and book issues. However, I fully expect to get caught up on the backlog of reviews this weekend. Reviews of Maverick: The Success Story Behind The World's Most Unusual Workplace, To Sell Is Human: The Surprising Truth About Moving Others, Situations Matter: Understanding How Context Transforms Your World and Capitalism, Socialism and Democracy are forthcoming. There was also a terrible book in there, which I may or may not get to.

Following that, I will be starting on Zuckerberg's Year of Books- I had to wait on a hold list to finally get my hands on them, so I expect to be a bit behind him in reading them.

Following that, I will be starting on Zuckerberg's Year of Books- I had to wait on a hold list to finally get my hands on them, so I expect to be a bit behind him in reading them.

Tuesday, January 6, 2015

[REVIEW] Drive: The Surprising Truth About What Motivates Us

Business books are almost never riveting reads. They are usually a slog through uninteresting case studies, mind-bogglingly bad visual aids and a few points of brilliance you probably could have looked up yourself on Wikiquote. Sprinkle in some buzzwords. Let simmer.

Amazon link: Drive: The Surprising Truth About What Motivates Us

UP NEXT: Maverick: The Success Story Behind the World's Most Unusual Workplace, Ricardo Semler

Drive: The Surprising Truth About What Motivates Us is an exception. I powered through it in 2 days and it never felt like a chore. This is despite having a title that sounds like a Buzzfeed title generator run amok. Don't get me wrong- it is still a business book and it is still intended to make you better at middle management or founding a startup or whatever. But it is more than that, besides.

Drive is, unsurprisingly, a book about human motivation. It is Dan Pink's contention that we (and by extension, the organizations we belong to and interact with) are stuck in an outdated mode of thinking about motivation- a mode of thinking that relies on carrots-and-sticks, rewards and punishments. A system Dan Pink calls Motivation 2.0, a system based on all the sort of things that would make B.F. Skinner squeal with delight. And Dan Pink doesn't agree with this system. Unlike many business books, he doesn't disagree and call it a day.

He begins the book with a study from the 1940s on problem solving in lower primates. Researcher Harry Harlow gathered together lab monkeys and presented them with a somewhat complicated lock and pin puzzle. The intention was to see if a system of rewards could entice them into learning how to operate and solve the puzzle. But it turned out the system of rewards was unnecessary- the monkeys threw themselves into the task of figuring out the puzzle before they were given any rewards. This made no sense in the behavioral theories of the day. Motivation in those days was viewed as a product of baser survival instinct (the first 'drive') and a hedonistic pursuit of pleasure and aversion to punishment and pain (the second 'drive'). The behavior of the lab monkeys required a third 'drive'- purely intrinsic and divorced from external rewards and punishments. It is from this third 'drive' that the book takes its name.

Next he moves on to the research efforts of Edward Deci. While a graduate assistant at Carnegie Mellon University, Deci assembled a group of research subjects to measure intrinsic and external motivators. One group remained unpaid for the duration of the study (three days of assembling the Soma puzzle, pictured below). This was the control and the members of this group remained relatively well-motivated and engaged throughout the course of the study. The other group, however, was paid for their performance on one of the days- after which payment was ceased. In a result that shouldn't surprise many people, the paid group performed better for the day which they were paid. But after the day they were paid, their motivation and effort fell below that of the unpaid group. From these results and other studies, Deci elucidated a theory of 'crowding out'- the idea that extrinsic rewards can actually remove or cancel out intrinsic motivation.

This theory of 'crowding out' is further explored in the negative effects of fines instituted by Israeli day cares (more famously seen in Freakonomics and Predictably Irrational.) Israeli day cares in the study tallied the number of tardy parents over a period of time. They were then divided into two groups- a control and an experimental group. The control group continued as before, merely tallying the number of parents late to pick up their children. The experimental group, meanwhile, instituted a fine to dissuade the tardy parents from showing up late to pick up their children. The end result is that tardiness actually increased at those daycares that instituted the fine- the creation of a punishment system had actually encouraged the behavior it was meant to discourage. The idea is that the institution of the punishment removed people's intrinsic motivation to not be tardy- a social obligation to the daycare workers- and replaced it with a price the tardy parents could rationalize. And when the fee system was removed? Parents continued to be late at the higher frequency seen during the study. Their intrinsic desire to not be late had been removed by the institution of a monetary punishment.

He doesn't stop there- he moves into 'positive psychology', self-determination theory, Mihaly Csikszentmihalyi's theories of flow and even the dreaded business case studies- exploring such institutions as Wikipedia (a platform where the only motivators are intrinsic), Atlassian (a software company following in Google's footsteps with 20% time), Meddius (a healthcare technology company where you only show up to work if you have to- what is called a "results-oriented work environment") and finally, Semco (the world's most successful example of workplace democracy and the subject of my next read). He uses examples from academia and business to further show that intrinsic motivators almost always win out over external motivators. Even if it didn't contribute anything of note, Drive would be a worthy read if only for all of the launching points it provides the reader.

It ends as all business books do- with a discussion guide. Drive calls it a Type I ("intrinsic motivation") Toolkit. It isn't just a series of bland reading comprehension questions or PowerPoint slides for the next corporate retreat. Drive's Type I Toolkit presents exercises that any person could use to determine their motivation and their trajectory in everyday life. Even the explicitly business-focused exercises are, as the chapter insists, applicable to anyone from an intern to a CEO. Consider the "pronoun test" created by Richard Reich- do you and your colleagues refer to the organization you are in as "they" or "we"? It can tell you a lot about the sort of organization you are in and where you are in it. The Toolkit even includes a Further Reading section not composed of the author's other books!

Overall, I would highly recommend Drive. It is not a very hard read and was worthwhile throughout. It definitely inspired a good amount of thinking, even though I had already seen some of the studies and examples contained in its pages. And as stated above, if nothing else, it is one of those books that opens up new avenues for exploration. Below, you can watch a video by RSA that provides a pretty good summary of many of the book's findings and conclusions- if you like the video, there is a good chance you will like the book.

Drive is, unsurprisingly, a book about human motivation. It is Dan Pink's contention that we (and by extension, the organizations we belong to and interact with) are stuck in an outdated mode of thinking about motivation- a mode of thinking that relies on carrots-and-sticks, rewards and punishments. A system Dan Pink calls Motivation 2.0, a system based on all the sort of things that would make B.F. Skinner squeal with delight. And Dan Pink doesn't agree with this system. Unlike many business books, he doesn't disagree and call it a day.

He begins the book with a study from the 1940s on problem solving in lower primates. Researcher Harry Harlow gathered together lab monkeys and presented them with a somewhat complicated lock and pin puzzle. The intention was to see if a system of rewards could entice them into learning how to operate and solve the puzzle. But it turned out the system of rewards was unnecessary- the monkeys threw themselves into the task of figuring out the puzzle before they were given any rewards. This made no sense in the behavioral theories of the day. Motivation in those days was viewed as a product of baser survival instinct (the first 'drive') and a hedonistic pursuit of pleasure and aversion to punishment and pain (the second 'drive'). The behavior of the lab monkeys required a third 'drive'- purely intrinsic and divorced from external rewards and punishments. It is from this third 'drive' that the book takes its name.

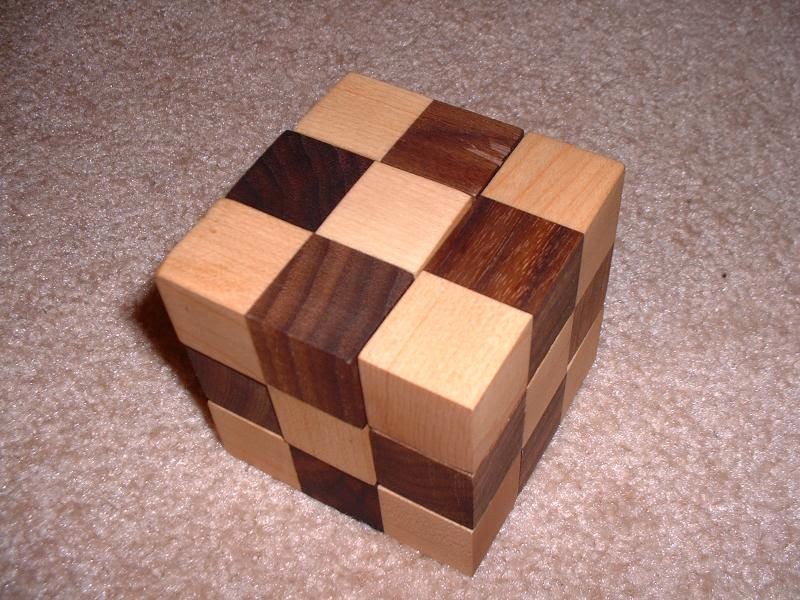

Next he moves on to the research efforts of Edward Deci. While a graduate assistant at Carnegie Mellon University, Deci assembled a group of research subjects to measure intrinsic and external motivators. One group remained unpaid for the duration of the study (three days of assembling the Soma puzzle, pictured below). This was the control and the members of this group remained relatively well-motivated and engaged throughout the course of the study. The other group, however, was paid for their performance on one of the days- after which payment was ceased. In a result that shouldn't surprise many people, the paid group performed better for the day which they were paid. But after the day they were paid, their motivation and effort fell below that of the unpaid group. From these results and other studies, Deci elucidated a theory of 'crowding out'- the idea that extrinsic rewards can actually remove or cancel out intrinsic motivation.

The soma puzzle, disassembled The soma puzzle completed- one of 240 solutions

(From Wikimedia Commons)

He doesn't stop there- he moves into 'positive psychology', self-determination theory, Mihaly Csikszentmihalyi's theories of flow and even the dreaded business case studies- exploring such institutions as Wikipedia (a platform where the only motivators are intrinsic), Atlassian (a software company following in Google's footsteps with 20% time), Meddius (a healthcare technology company where you only show up to work if you have to- what is called a "results-oriented work environment") and finally, Semco (the world's most successful example of workplace democracy and the subject of my next read). He uses examples from academia and business to further show that intrinsic motivators almost always win out over external motivators. Even if it didn't contribute anything of note, Drive would be a worthy read if only for all of the launching points it provides the reader.

It ends as all business books do- with a discussion guide. Drive calls it a Type I ("intrinsic motivation") Toolkit. It isn't just a series of bland reading comprehension questions or PowerPoint slides for the next corporate retreat. Drive's Type I Toolkit presents exercises that any person could use to determine their motivation and their trajectory in everyday life. Even the explicitly business-focused exercises are, as the chapter insists, applicable to anyone from an intern to a CEO. Consider the "pronoun test" created by Richard Reich- do you and your colleagues refer to the organization you are in as "they" or "we"? It can tell you a lot about the sort of organization you are in and where you are in it. The Toolkit even includes a Further Reading section not composed of the author's other books!

Overall, I would highly recommend Drive. It is not a very hard read and was worthwhile throughout. It definitely inspired a good amount of thinking, even though I had already seen some of the studies and examples contained in its pages. And as stated above, if nothing else, it is one of those books that opens up new avenues for exploration. Below, you can watch a video by RSA that provides a pretty good summary of many of the book's findings and conclusions- if you like the video, there is a good chance you will like the book.

Amazon link: Drive: The Surprising Truth About What Motivates Us

UP NEXT: Maverick: The Success Story Behind the World's Most Unusual Workplace, Ricardo Semler

Sunday, January 4, 2015

[REVIEW] Capital in the Twenty-First Century

I just finished reading Thomas Piketty's Capital in the Twenty-First Century. For those who are unaware (or who didn't finish it) Thomas Piketty's book is all about the past, present and future of wealth and income inequality. The increased public attention paid to this issue (Remember 'We Are The 99%'?) is probably what put this book on the New York Times Best Seller List. The relatively dry nature of the history of economic inequality is probably what left it one of the most unfinished.

All that being said, I found it to be a relatively easy and pleasant read. Piketty's treatise on the history of economic inequality could have been dense, arcane and completely incomprehensible to the normal reader- but it isn't. It is almost refreshing to read an economics book that isn't written for academic eyes only. Some of that is because, well, Piketty isn't exactly your average economist. (For one, his book made the New York Times Best Seller List. That probably makes him an outlier.)

Piketty is an economic historian and that makes all the difference. Capital reads like a history book and the portions dealing with the history of income inequality are really, the best parts. One of the more pleasant surprises is Piketty's use of literary examples of the stratified and highly inegalitarian societies he analyzes- Jane Austen, Honore de Balzac and Henry James are all referenced. Piketty manages to humanize the text and give the reader a better sense of scale when he begins to discuss inequality in more quantitative depth. Charts and graphs are presented where immediately relevant and useful, which is not often the case in books like Capital. (The footnotes and the book's website are for a specific type of power-reader.) Piketty managed to bring the highly stratified, inegalitarian society of the past to life- and that is no mean feat for an economics tome.

It is when Piketty strays from economic history that he begins to falter. The rest of the book is composed of his own forecasts of economic inequality and finally, his policy recommendations for how to deal with the 'contradiction of capitalism.' I'm not here to argue about his conclusions- plenty of more qualified people can waste their time doing so more effectively than I can. There's still plenty of good information to be found and a few bright points. (Ingenious indirect measurements always impress me, whether in the 'hard' or 'soft' sciences and Piketty's use of college endowment data to examine sovereign wealth funds is certainly ingenious.) It's just that these final portions of Capital were not as engaging and were much closer to what I imagined the entire book would be.

Overall, Thomas Piketty's Capital in the Twenty-First Century was a good read and certainly one I will revisit. The history is brilliant (especially when one realizes that Piketty is working on virgin soil- this is the first work to truly explore economic inequality in such depth.) Even where the rest of the book is less interesting, it is no less edifying. I'd highly recommend it to those interested in economics or social justice. It isn't often enough that those two interests coincide- and even more rare when they coincide in a book written for the modern reader.

Final musing: Piketty's policy recommendations were remarkably less radical than I had expected, given the vitriol directed at him by The Financial Times and FOX News, among others. It isn't often that a book all about economic inequality ends with "Let's tax all wealth at a marginal rate and strive for more transparent accounting practices" instead of "Kill the bastards" or "Property is theft".

NEXT UP: Drive: The Surprising Truth About What Motivates Us, Daniel H. Pink

All that being said, I found it to be a relatively easy and pleasant read. Piketty's treatise on the history of economic inequality could have been dense, arcane and completely incomprehensible to the normal reader- but it isn't. It is almost refreshing to read an economics book that isn't written for academic eyes only. Some of that is because, well, Piketty isn't exactly your average economist. (For one, his book made the New York Times Best Seller List. That probably makes him an outlier.)

Piketty is an economic historian and that makes all the difference. Capital reads like a history book and the portions dealing with the history of income inequality are really, the best parts. One of the more pleasant surprises is Piketty's use of literary examples of the stratified and highly inegalitarian societies he analyzes- Jane Austen, Honore de Balzac and Henry James are all referenced. Piketty manages to humanize the text and give the reader a better sense of scale when he begins to discuss inequality in more quantitative depth. Charts and graphs are presented where immediately relevant and useful, which is not often the case in books like Capital. (The footnotes and the book's website are for a specific type of power-reader.) Piketty managed to bring the highly stratified, inegalitarian society of the past to life- and that is no mean feat for an economics tome.